Are we in a recession?

What is the definition of a recession?

A recession is generally considered a widespread and long-term decrease in economic activity. Economic activity is any process that leads to the manufacture or production of various goods and services. Economic activity leads to expanded business growth and widespread expansion of the labor market. Recessions typically result in a decline in industrial production, retail sales, and an increase in the unemployment rate.

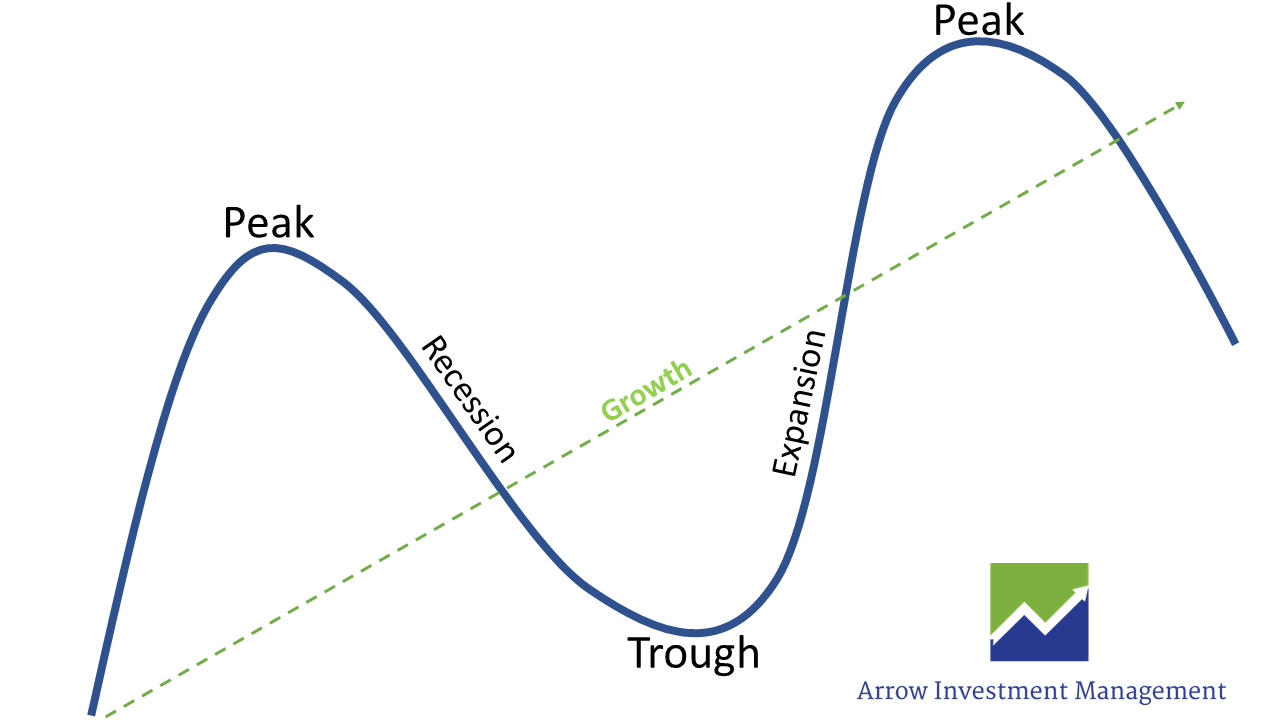

Recessions are a normal part of the business cycle. The business cycle describes how economic activity (measured as inflation-adjusted Gross Domestic Product) grows as employment, industrial production, employment, and retail sales increase, peak, then decline and enter a trough before they start growing again. A recession is the decline from a peak, while a depression would be a prolong period in a trough, where there is little growth in economic activity. Eventually, economic activity grows again, and a recovery begins.

Recessions are abrupt and short. They are brief corrective part of the overall growth and development of an economic system. Over the past 50 years, the U.S. has only been in a recession roughly 10% of the time (source- International Monetary Fund).

What are recession indicators?

Can you predict a recession? This is difficult because recessions are only discernable in retrospect when data about economic activity and GDP become available. The stock market can be a barometer for predicting recessions, but the market is so forward-looking that the price moves can anticipate a recession and then begin recovering well before the recession is even over. The stock market is not the economy, but rather a forward-looking prediction of future economic activity.

There are some broad indicators (“leading indicators”) that can also predict recessions. One of those is an inverted yield curve. An inverted yield curve is when short-term interest rates have higher yields than long term interest rates. This happens because investors move money away from short-term bonds and into long-term ones, which suggests a pessimistic prediction of economic activity. Buying long-term bonds drives the price upwards and the yield downwards, even below the yields of short-term bonds.

Other leading indicators include the Consumer Confidence Index (CCI) or how confident consumers are about the economy and their perception of prices and outlook, and durable goods orders, which are a measure of large equipment expenditures by manufacturing companies. Durable goods are large expensive pieces of equipment that last longer than three years. They vary between manufacturing and computer equipment, machinery, and even vehicles. If orders for these big-ticket items are declining, it is often considered a negative predictor for economic activity.

Are we in a recession?

There are two separate ways to define a recession in the U.S. The first is informal and widely used by the media, but not by professional economists or financial professionals. It is defined by two successive quarters of negative GDP growth. This is often called a “technical recession”. By that measure the U.S. is currently in a recession: Q1 2022: -1.6%, Q2 2022: -0.6%, though it would be extremely mild and also accompanied by a very strong labor market (3.6% unemployment rate), which would be atypical of a recession.

Are we going into a recession?

The National Bureau of Economic Research (NBER) Business Cycle Dating Committee officially defines recessions in the U.S. by estimating positions within the business cycle using variables like employment, personal income minus government transfers, consumer spending and industrial production. They have unequivocally stated that the U.S. is not yet in a recession, based on their indicators. The NBER did state that the U.S. was in a recession in April 2020, after most of the U.S. economy shut down because of the pandemic. That recession lasted only two months and was the shortest in U.S. history.

Most economists are predicting the U.S will enter an actual recession in early 2023, because rising interest rates will have more time to permeate the economy and slow business growth.